how much is child benefit

As a rule a single parent will be able to claim current Child Benefit payments for the eldest or only child until they turn 16 years old exceptions apply for children age 16 to 19 years. For each child aged 6 through 17 the IRS will pay up to 3000 divided in the same way.

Pin On Painting Projects Ideas

Thats why we will withdraw child benefit from households with a higher rate taxpayer.

. How much is Child Benefit. Payments will increase by 31 from April 2022 along with several other benefits including Universal. You can get Child Benefit if your or your partners individual income is over 50000 but you may be taxed on the benefit. These payments go out to parents of children under.

There is however a maximum family allocation usually about 150 percent to 180 percent of the deceased parents total benefit. Personal details about the children in your care. Factors like income family size and type of care determine how much support families can get. Jordan Press The Canadian Press Posted.

Canada Child Benefit still needed alongside national daycare system minister says. A 2105 per week Child Benefit rate. A 1395 per week Child Benefit rate. Start now Before you start.

106 PM CST. CHILD benefit rates are set to rise next year giving parents extra cash to spend on essentials. When calculating how much child benefit must be repaid via the tax charge your net-adjusted income is taken into account. A child can only collect under one parents work record so SSA chooses the higher one.

Number of children Annual. To work out if you are within the Benefit Cap the Department for Work and Pensions DWP adds together the amount you have been awarded of the following benefits. Child Benefit is one of the most common benefits that is paid out in the United Kingdom. The weekly rate of guardians allowance is per child and in addition to child benefit.

What counts as income. Two Child Benefit rates are in place with one being for the eldest child and another for any further children. Information from previous benefit payments. Before you call To verify your identity youll need Social Insurance Number.

Employment and Support Allowance except when in the Support Group Housing Benefit except for households in Supported Exempt Accommodation. For dependents aged 18 or full-time college students up through age 24 the IRS will make a. Families Minister Karina Gould says the Canada Child Benefit was never designed as a child-care program but to help parents defray the costs of raising a family and reduce poverty rates. The government has basically defined two Child Benefit rates.

The governments economic update in December forecasted spending on the child benefit would fall for the second straight fiscal year starting in. Children are referred for a psychological assessment for many reasons. Weve got to be tough but fair. For the eldest son or a unique child.

This includes everything youd normally have to declare for tax purposes and is. Since the income-tested benefit was introduced in 2016 the poverty rate for children under 18 has fallen to 97 per cent in 2019 the most recent year for which data is. The table below highlights how much child benefit a family with two kids will get after tax. You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments.

The amount you receive depends on your family net income in 2019 and 2020. The High Income Child Benefit tax charge you or your partner may have to pay. How Much Do You Get for Child Benefit a Week. They may have attention or behavior problems at home or in school be subjected to bullying be depressed or anxious or have a.

Infant supplement is an extra child benefit for single parents who have a child between the ages of 0 - 3 years and who are receiving extended child benefit and full transitional benefit. The CCB young child supplement is paid to families who are entitled to receive a Canada child benefit CCB payment in January April July or October 2021 for each child under the age of six. Extended child benefit is child benefit for one child more than you are actually living with. Call this number if you need to speak to an agent to make payment arrangements.

By making higher deductions such as pension contributions you can reduce your net-adjusted income and increase the amount of. For any additional children. The governments economic update in December forecasted spending on the child benefit would fall for the second straight fiscal year starting in. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child to 3600 for children below the age.

Families need to renew their application every year. And its very difficult to justify taxing people on low incomes to pay for the child benefit of those earning so much more than them. Here are some examples of Child Benefit sums you could claim following your family situation. This is known as the High Income Child Benefit Tax Charge.

The Affordable Child Care Benefit is a monthly payment to help eligible families with the cost of child care. How A Psychological Assessment Can Benefit Your Child. These days weve really got to focus the resources where they are most needed. If you received too much CCB or other child and family benefits you need to repay them.

Tax-free Child Benefit helps towards the cost of raising children. - from 5 January 2009. Ordinary child benefit is a fixed amount per child. The child is eligible for 75 percent of this amount.

Child benefit from Jan 2013. How much is Child Benefit. 28 2021 Last Modified. You can receive a maximum monthly benefit of 56941 per child below 6 or 48041 for those above if your adjusted family net income is below 32028.

How much child benefit will you receive. If there are multiple children and the total of their benefits exceeds the maximum SSA reduces each. How much is child benefit in Canada per month. Annual child benefit after tax.

Ultimately how much you receive depends on your prior years adjusted family net income the number of kids in the family their age and your marital status. 1238 PM CST Tuesday Dec. How much Child Benefit you receive in a tax year. Based on family with two kids.

You may get an extra amount per week for other children if you have more than. How A Psychological Assessment Can Benefit Your Child Posted by Dr. The net-adjusted income is what you have left after other deductions from your salary such as pension contributions.

The Child Benefit Building Blocks Infographic Allowance For Kids Money Advice Infographic Health

Does Physical Activity Improve Behavior How Much Exercise Do Kids Need What Are The Ben Exercise For Kids How To Increase Energy Physical Activities For Kids

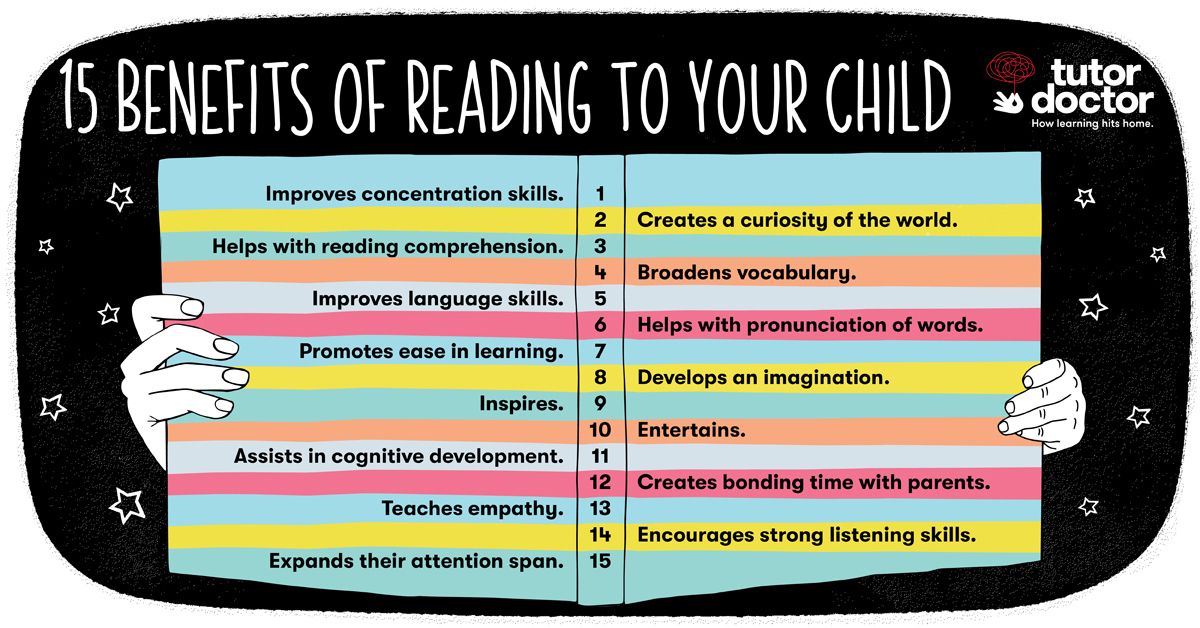

15 Benefits Of Reading To Your Child Improve Reading Skills Doctor For Kids Reading Comprehension

How To Maximize Your Canada Child Benefit Ccb Genymoney Ca Personal Finance Lessons Frugal Activities Free Stuff Canada

Child Benefit Payments 2016 Bank Holiday July 12th Nir Yearly Calendar Template Event Calendar Template Excel Calendar

Posting Komentar untuk "how much is child benefit"